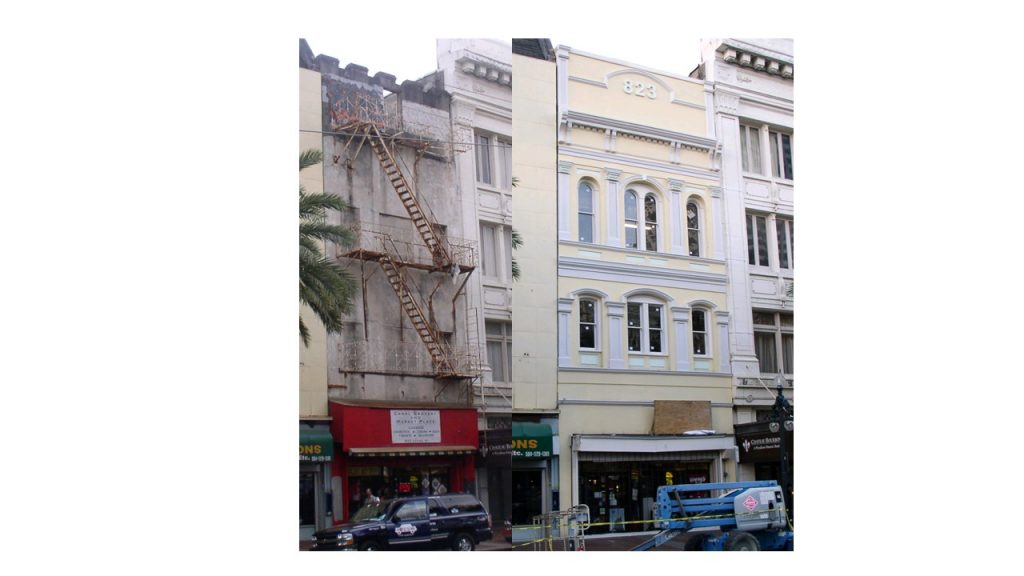

823 Canal St. was one of the most challenging façade restorations to date. The late Victorian building, dating from the 1890s had been significantly altered from the 1950s through the 1970s. Using historic reference photos we were able to recreate a near replica of the original building. All of the architectural details in this project, along with the windows, had to be completely recreated.

The DDD offers grants and assistance exclusive to downtown businesses. All applicants must schedule a meeting with the Downtown Development District staff to review funding availability and program requirements. Grants are only eligible to non-tax-exempt organizations.